Unmasking The Truth: What "xxxxxx Is Equal To" Really Means For You

It's a common feeling, isn't it? That little ping of worry when you see something important, yet it's hidden behind a series of asterisks or "x" marks. You're left wondering, what exactly is that sensitive piece of information? What "xxxxxx is equal to" becomes a question that truly matters, especially when it touches on your money, your identity, or your peace of mind.

In our daily lives, we often encounter situations where crucial details are obscured. Maybe it's a routing number shown as a string of 'x's, or an email hinting at activity you don't recognize. These moments, they really can make you pause. Knowing what those hidden values truly represent, or what "xxxxxx is equal to" in these instances, isn't just about curiosity; it's about making sure everything is as it should be.

This article will explore why understanding what "xxxxxx is equal to" is so important. We'll look at how these hidden details can impact your financial well-being and your digital security. We'll also consider how to make sure the obscured information actually matches the truth. So, let's talk about the importance of clarity in a world where some things are often kept from plain sight.

Table of Contents

- Understanding What "xxxxxx is Equal to" Really Means

- The Importance of Verification: When "xxxxxx" Isn't What You Expect

- Protecting Your Digital Identity: Ensuring "xxxxxx" Matches You

- System Accuracy and "xxxxxx": Bridging the Gaps

- Steps to Confirm "xxxxxx is Equal to" the Truth

- Frequently Asked Questions

- Bringing It All Together

Understanding What "xxxxxx is Equal to" Really Means

When you come across "xxxxxx" in a digital context, it's typically a placeholder. It stands in for sensitive data that systems or people don't want to show openly. This could be anything from a part of your bank account number, a section of your Social Security number, or even a unique identifier in a system. It's almost like a secret code, just for you to know the full picture. The question then becomes, what "xxxxxx is equal to" in that specific situation?

Consider your financial transactions, for instance. When you see a partial account number on a statement, or when a refund amount seems off, that "xxxxxx" might represent the full, correct figure. It's a way of saying, "Here's a hint, but you need to confirm the rest." This concept applies to many parts of our online lives, where privacy and security are really important. So, understanding this placeholder is a first step to keeping things safe.

Sometimes, "xxxxxx" might even be used in system messages. A notification about a "break in xxxxxx health plan coverage" implies a specific period or type of coverage that needs checking. The system is trying to tell you something, but it's using a general term. Knowing what "xxxxxx is equal to" in these messages helps you figure out what action you might need to take. It's all about clarity, really, and making sure you're on the same page as the information you're seeing.

The Role of Placeholders in Digital Security

Using "xxxxxx" as a placeholder serves a vital purpose in digital security. It helps protect your private details from prying eyes. If every number or piece of personal data were always visible, it would be much easier for others to misuse it. So, in a way, it's a good thing that some information is masked. Yet, this masking also puts the responsibility on you to verify what "xxxxxx is equal to" when it matters most.

This practice is pretty standard across many platforms, from banking websites to tax software. They show just enough information for you to recognize it, without giving away the whole story. This balance between security and usability is a delicate one. It means you have to be vigilant. You need to confirm that the obscured data matches what you expect. This is especially true when dealing with financial matters, where precision is key.

Think about an email from a service provider that mentions "xxxxxx@x.xxxxxxxx.xxxxxx.xxx." That email address is masked for a reason. But if you're trying to figure out if the email is legitimate, knowing what "xxxxxx is equal to" in that context—meaning, the actual sender's address—becomes very important. It's a small detail, yet it can make a big difference in protecting yourself from scams. This careful approach to information is just part of being online today.

The Importance of Verification: When "xxxxxx" Isn't What You Expect

The real trouble starts when what "xxxxxx is equal to" doesn't match what you know to be true. This is where the need for verification becomes absolutely critical. Imagine you've entered your bank details, but then you see them recorded as all 'x's. Or, you get a notification about a "break in coverage" that you're sure never happened. These discrepancies can be alarming, and they point to a need to dig deeper.

One common issue arises with financial transactions. You might be expecting a certain refund amount, only to receive a deposit that's "no where near my whole refund." In this case, the "xxxxxx" representing the full refund amount clearly isn't equal to the partial deposit you received. This kind of situation calls for immediate investigation. It's a sign that something might have gone wrong, or that there are fees you weren't aware of. You really need to get to the bottom of it.

Another concerning scenario involves identity. What if you receive an email claiming "someone else filed my return this year under a different account"? Here, the "xxxxxx" could refer to your tax return, or your identity itself. If that "xxxxxx" is equal to someone else's activity, it's a serious red flag. It points to potential fraud and means you need to act quickly to protect your personal information. These kinds of alerts are not to be ignored, and you know, they really can cause a lot of stress.

Spotting Discrepancies in Digital Records

Spotting these discrepancies is a vital skill in our digital age. Sometimes, it's as simple as noticing a routing number that appears wrong after you've entered it. The system might display it as "all x's," but if you have a gut feeling, or if it just doesn't look right, that's a clue. It's like a little warning light going off. You need to trust that feeling and double-check what "xxxxxx is equal to" in your records versus what the system shows.

Even seemingly minor issues, like how a system handles hyphens in an ID number, can point to bigger problems. If an entry that "can either be ein or federal id" gets hyphenated incorrectly, it might mean the system isn't processing your data as accurately as it should. These small errors can snowball into larger headaches down the line. So, paying attention to these details, even the tiny ones, is really quite important for ensuring everything lines up.

The goal is always to ensure that the obscured "xxxxxx" truly matches the accurate, intended information. When it doesn't, it's not just an inconvenience; it can lead to financial losses, identity theft, or missed opportunities. So, understanding that a mismatch means action is needed is a key takeaway. You really can't be too careful when it comes to your personal data, and that's just the way it is.

Protecting Your Digital Identity: Ensuring "xxxxxx" Matches You

Your digital identity is a precious thing, and making sure that "xxxxxx" consistently equals *you* is paramount. In a world full of online interactions, it's easy for things to get mixed up, or for bad actors to try and pretend they are you. The provided text touches on this directly, with concerns about someone else filing a return or receiving suspicious emails. This is where being vigilant about your identity comes into play.

Consider the scenario of an unexpected email about your tax return. If it says "someone else filed my return this year under a different account," that's a major alarm. The "xxxxxx" here, representing your return or account, is clearly not equal to your own actions. This means a potential identity breach. You need to verify who that "xxxxxx" truly belongs to, and if it's not you, then steps must be taken to secure your information. It's a very serious matter, you know, and it requires immediate attention.

Similarly, if you're trying to gain access to a forum or a service, and you're told you can't "send pm untill certain criteria are met," like having a certain number of posts, that's about verifying your legitimacy within that community. The "xxxxxx" here might be your user status or your post count. Ensuring that "xxxxxx is equal to" the required activity means you are a legitimate user. It's a way for systems to confirm you are who you say you are, and that's pretty important for keeping online spaces safe.

Recognizing Phishing Attempts and Fraud

A big part of protecting your digital identity is recognizing phishing attempts. These are often emails or messages that try to trick you into giving up sensitive information. An email from "xxxxxxxx@x.xxxxxxxx.xxxxxx.xxx" could be a scam, especially if it makes urgent demands or sounds too good to be true. The "xxxxxx" in the sender's address is deliberately obscured, but the real question is, what "xxxxxx is equal to" in terms of its true origin?

If you can't immediately verify the sender, or if the message seems off, it's best to be cautious. Fraudsters often rely on you not checking what "xxxxxx is equal to" in their deceptive messages. They want you to assume it's legitimate. Always double-check the sender's full email address, and never click on suspicious links. It's a bit like being a detective, you know, looking for clues to see if something is genuine or not.

Your personal details, like your routing number or account number, are targets for these scams. When you enter these numbers into a legitimate system, they might be displayed as "x's" for security. But if you're asked for them in an unusual way, or if you suspect a system has recorded them wrongly, you need to investigate. Ensuring that your "xxxxxx" (your actual numbers) are correctly and securely held is a constant task. It's a bit of a hassle, but it's really necessary for your safety online.

System Accuracy and "xxxxxx": Bridging the Gaps

Beyond personal vigilance, the accuracy of the systems we use plays a huge role in ensuring that "xxxxxx is equal to" what it should be. Software and online platforms are designed to handle vast amounts of data, but even the best systems can have quirks or make mistakes. When these happen, it can lead to confusion or even financial issues. It's like a tiny cog in a big machine being slightly off, and that can cause a ripple effect.

Take, for instance, how a system handles specific data formats. The text mentions how a tax software "automatically add hyphen for an entry that can either be ein or federal id." It goes on to say it "hyphens correctly for ein but not for federal id (two hyphens at different locations)." Here, the "xxxxxx" could be the EIN or Federal ID number. If the system isn't consistently processing these numbers, then what "xxxxxx is equal to" in the system's database might not match what you originally entered. This kind of technical glitch can lead to processing errors, and that's just not what anyone wants.

Another example relates to financial deposits. If you're expecting a full refund, but receive a deposit from "tpg products sbtpg llc" that "isn’t no where near my whole refund," it means the "xxxxxx" (your expected full refund) is not equal to the amount received. This discrepancy might be due to fees, or it could be a system error. Understanding how these third-party processors work, and what fees they might deduct, is important. It's about bridging the gap between what you anticipate and what actually happens, and that can sometimes be a bit of a puzzle.

The Impact of Data Entry and Processing

Data entry is a fundamental part of interacting with online services, and its accuracy directly impacts what "xxxxxx is equal to" in the system's records. If you enter your routing number and account number, and the system records it as "all x's" and sends it to the IRS that way, it's a problem. Even if the 'x's are just a display feature, the underlying data needs to be correct. You need to be sure that the numbers you typed are the numbers the system stored. This is a very basic, yet very important, aspect of data integrity.

Sometimes, the issue isn't with your entry, but with how the system interprets or processes it. Adjustments to amounts, or the application of fees, can change the final "xxxxxx" amount you receive. If you "make the selections shown in the screenshots below" and can "enter the adjustment amount but i also need to" understand how it affects the total, that's about system transparency. You need to know how the system arrives at its final figures. This transparency helps you confirm that the final "xxxxxx" (the amount or status) is what you expect, and that's just good practice.

Ultimately, bridging the gaps in system accuracy requires a combination of careful user input and reliable system design. When there's a mismatch between what "xxxxxx is equal to" on your end and what the system shows or processes, it's a signal to investigate. It's about ensuring that the digital tools we rely on are working precisely as they should. This collaboration between user and system is really quite important for avoiding headaches down the line.

Steps to Confirm "xxxxxx is Equal to" the Truth

So, what can you actually do when you're left wondering what "xxxxxx is equal to" or if the obscured information is truly accurate? Taking proactive steps is key to protecting yourself and ensuring your digital interactions go smoothly. It's about being a bit of a detective, really, and making sure all your ducks are in a row.

1. Verify the Source

If you receive an email or message that makes you question what "xxxxxx is equal to," first, verify the sender. Don't click on links in suspicious emails. Instead, go directly to the official website of the company or service mentioned. For example, if you get an email about your tax return, go to the IRS website or your tax software's official site by typing the address yourself. This helps you avoid phishing scams, which are really quite common. You want to be absolutely sure you're dealing with the right people.

2. Cross-Reference Information

Always cross-reference any questionable "xxxxxx" with your own records. If a system shows a partial account number, compare it to your full account number on a physical statement or a trusted digital record. If there's a notification about a "break in coverage," check your policy documents. This simple step can quickly tell you if what "xxxxxx is equal to" in the message aligns with your actual situation. It's a bit like checking your homework, you know, just to be sure.

3. Contact Official Support

If you're still unsure about what "xxxxxx is equal to," or if you've identified a clear discrepancy, contact the official support channel for the service or company. Do not use phone numbers or email addresses provided in suspicious messages. Find the official contact information on their website. Explain your concern clearly. They can often clarify what "xxxxxx is equal to" in their system and help resolve any issues. This is often the quickest way to get things sorted out, and they can really help you understand what's going on.

4. Monitor Your Accounts

Regularly monitor your bank statements, credit reports, and online accounts for any unauthorized activity. This ongoing vigilance helps you catch issues early. If you see a transaction you don't recognize, or if a service indicates a status for "xxxxxx" that doesn't make sense, act on it immediately. Being proactive means you're more likely to spot problems before they become big headaches. It's a bit like keeping an eye on your garden, you know, making sure everything is growing as it should.

5. Update Security Practices

Finally, keep your online security practices up to date. Use strong, unique passwords for all your accounts. Enable two-factor authentication whenever possible. These measures add extra layers of protection, making it much harder for someone else to pretend that "xxxxxx is equal to" their identity instead of yours. It's a small effort that can make a very big difference in keeping your digital life secure.

Frequently Asked Questions

How can I check if my financial details are correct online?

- To check your financial details, always log directly into your bank's official website or app. Never use links from emails. Once logged in, review your account information carefully. Compare what's displayed with your physical statements or trusted records. If you see any obscured numbers like "xxxxxx," make sure you understand what they represent, and if possible, confirm the full number through a secure channel.

What should I do if I get an email about an unauthorized tax filing?

- If you receive an email claiming someone else filed your tax return, do not reply to the email or click on any links. This is often a scam. Instead, contact the IRS directly using the official phone numbers or website. You can also reach out to your tax software provider through their verified support channels. They can help you confirm the status of your return and advise on next steps if there's actual unauthorized activity.

Why do online forms sometimes show "x" for my sensitive information?

- Online forms show "x" or asterisks for sensitive information, like parts of your bank account or Social Security number, for security reasons. This practice, called masking, protects your data from being seen by others who might be looking over your shoulder or if your screen is captured. While it can make you wonder what "xxxxxx is equal to," it's a standard security measure to keep your private details safe. You usually only see the full number when you're entering it, or sometimes if you specifically choose to reveal it.

Bringing It All Together

The phrase "xxxxxx is equal to" might seem simple, but it points to a very important aspect of our digital lives: the need for clarity and verification. Whether it's a masked account number, a suspicious email, or an unexpected system notification, understanding what those obscured details truly represent is vital. It's about protecting your financial well-being, safeguarding your identity, and ensuring that the systems you rely on are working correctly. Being aware and taking proactive steps to confirm these hidden truths can save you a lot of worry and trouble.

Remember, your vigilance is your best defense. By questioning, cross-referencing, and using official channels, you can ensure that what "xxxxxx is equal to" in your digital world always aligns with the truth. Stay informed, stay secure, and keep those important details clear in your mind. You can learn more about protecting your personal information from official sources. Also, learn more about data security practices on our site, and check out this page for tips on preventing online fraud.

Computer Organization CS345 David Monismith Based upon notes by Dr

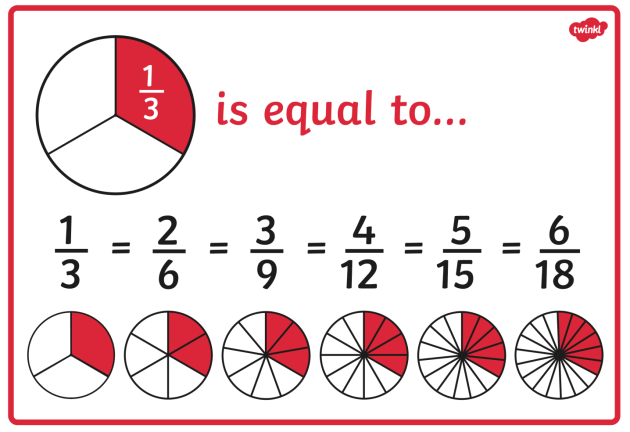

What are Equivalent Fractions? Definition & Examples | Teaching Wiki

Greater Than or Equal to Sign in Mathematics - GeeksforGeeks