Without Recourse Endorsement: Your Shield In Money Matters Explained Simply

Have you ever come across legal language that feels like a foreign tongue, making you wonder what you're truly agreeing to? It's a feeling many people share, especially when dealing with money or agreements. One phrase that often pops up in these situations, and can be a bit confusing, is "without recourse endorsement." Knowing what this means is, you know, pretty important for anyone involved in financial dealings, whether you're lending money, getting a loan, or even just dealing with a check. This idea can really change who is responsible if things go sideways with a payment.

It's a bit like asking if you take your coffee with or without sugar, or remembering not to leave home without your wallet. Just as life on earth wouldn't be possible without water, some financial arrangements simply wouldn't make sense without a clear understanding of who holds the risk. We're going to break down this concept, so it feels less like a riddle and more like something you can actually use. You see, it's about not having something, or lacking something, in a very specific financial way.

This discussion aims to make a rather formal idea feel much more approachable. We want to show you how "without recourse endorsement" works, why it matters, and what it could mean for you. By the end of this, you should feel much more prepared to spot this term and understand its true meaning. It's, well, honestly a pretty good thing to know.

Table of Contents

- What Does "Without Recourse Endorsement" Really Mean?

- When Does This Come Up? Common Uses

- Why Does Anyone Use "Without Recourse"?

- "With Recourse" Versus "Without Recourse": A Key Difference

- What to Consider Before You Sign or Accept

- Frequently Asked Questions About Recourse

- Protecting Your Financial Position Today

What Does "Without Recourse Endorsement" Really Mean?

Let's get right to the heart of it. The phrase "without recourse endorsement" combines a few ideas, and understanding each part helps make the whole thing clear. It's, you know, a bit like understanding individual ingredients in a recipe. The word "without" itself, as we often use it, simply means 'not having something' or 'lacking something'. Think about how you might say, "He came out without a coat," or "She wore a brown shirt pressed without a wrinkle." It indicates an absence.

The "Without" Part: Lacking Something

When we talk about something being "without" something else, we're talking about an omission or an avoidance. Like, if you are without a beard, you simply don't have one. In a financial context, this "without" suggests that a certain right or responsibility is absent. It means a party is giving up a claim they might otherwise have. This concept, you see, is pretty straightforward in everyday language.

The "Recourse" Part: Seeking Payment Back

Now, "recourse" is the word that holds a lot of weight here. It means the right to demand payment or action from someone else if a debt or obligation isn't met. If you have "recourse," it means you can go back to the person who originally signed something or made a promise, and ask them to make good on it if the primary payer fails. It's, well, a way to get your money or what's owed to you, should the first attempt not work out.

Putting It Together: No Comeback

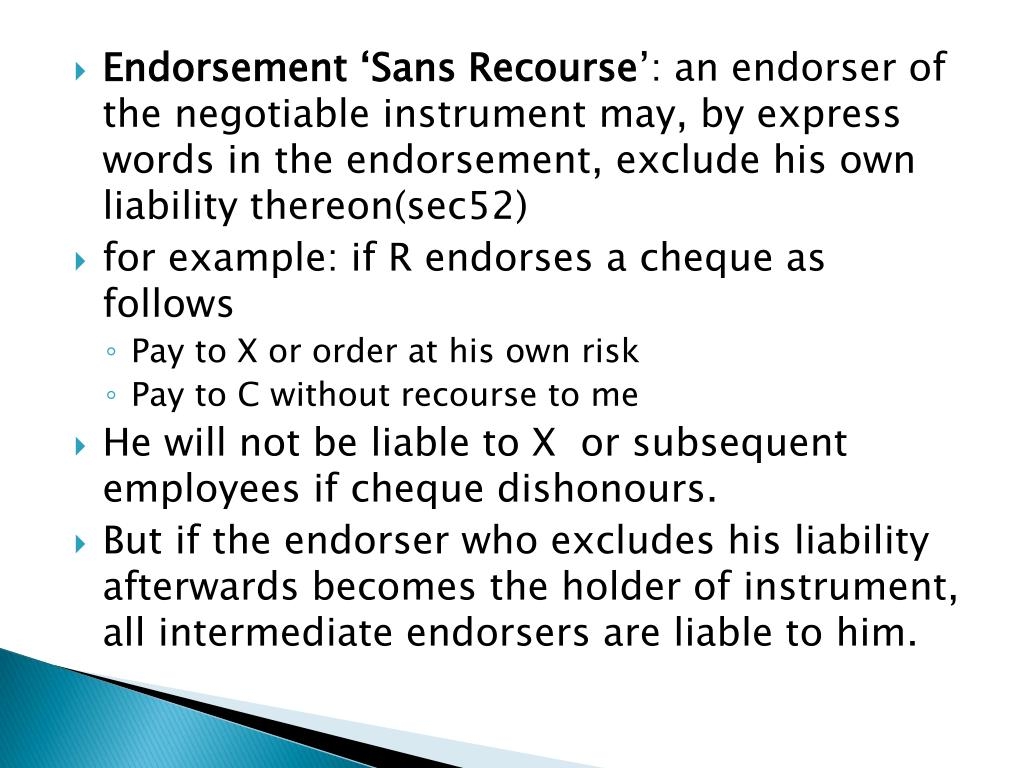

So, when you put "without" and "recourse" together in the context of an "endorsement," it means the person who is signing over a financial instrument (like a check or a promissory note) is doing so without taking on responsibility for its future payment. In other words, if the person who is supposed to pay doesn't, the person who endorsed it "without recourse" cannot be forced to pay instead. It's a way, you know, to pass something along while shedding potential future money worries related to it.

When Does This Come Up? Common Uses

This type of endorsement isn't something you see every day, but it shows up in some specific financial situations. Knowing where it typically appears can help you spot it and understand its implications. These instances usually involve transferring a financial right from one person or group to another. It's, you know, pretty much always about who carries the risk.

Promissory Notes: Lending Money

Imagine someone lends money to a friend, and the friend signs a promissory note, which is a promise to pay back the loan. If the original lender then wants to sell that note to someone else, they might endorse it "without recourse." This means if the friend who originally borrowed the money doesn't pay, the new holder of the note can't come back to the original lender asking for the money. The original lender is, well, out of the picture regarding that debt.

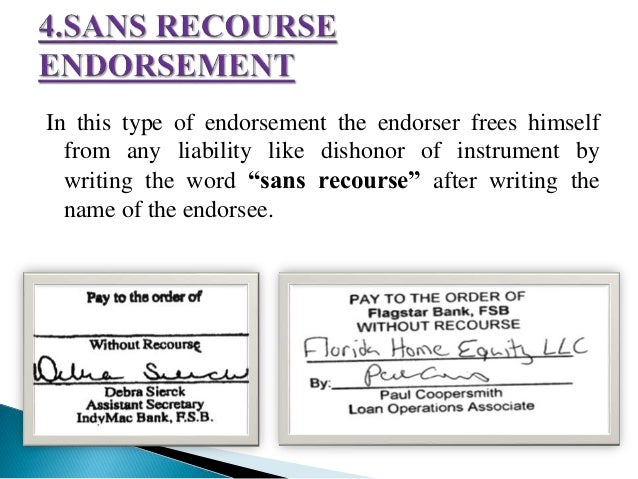

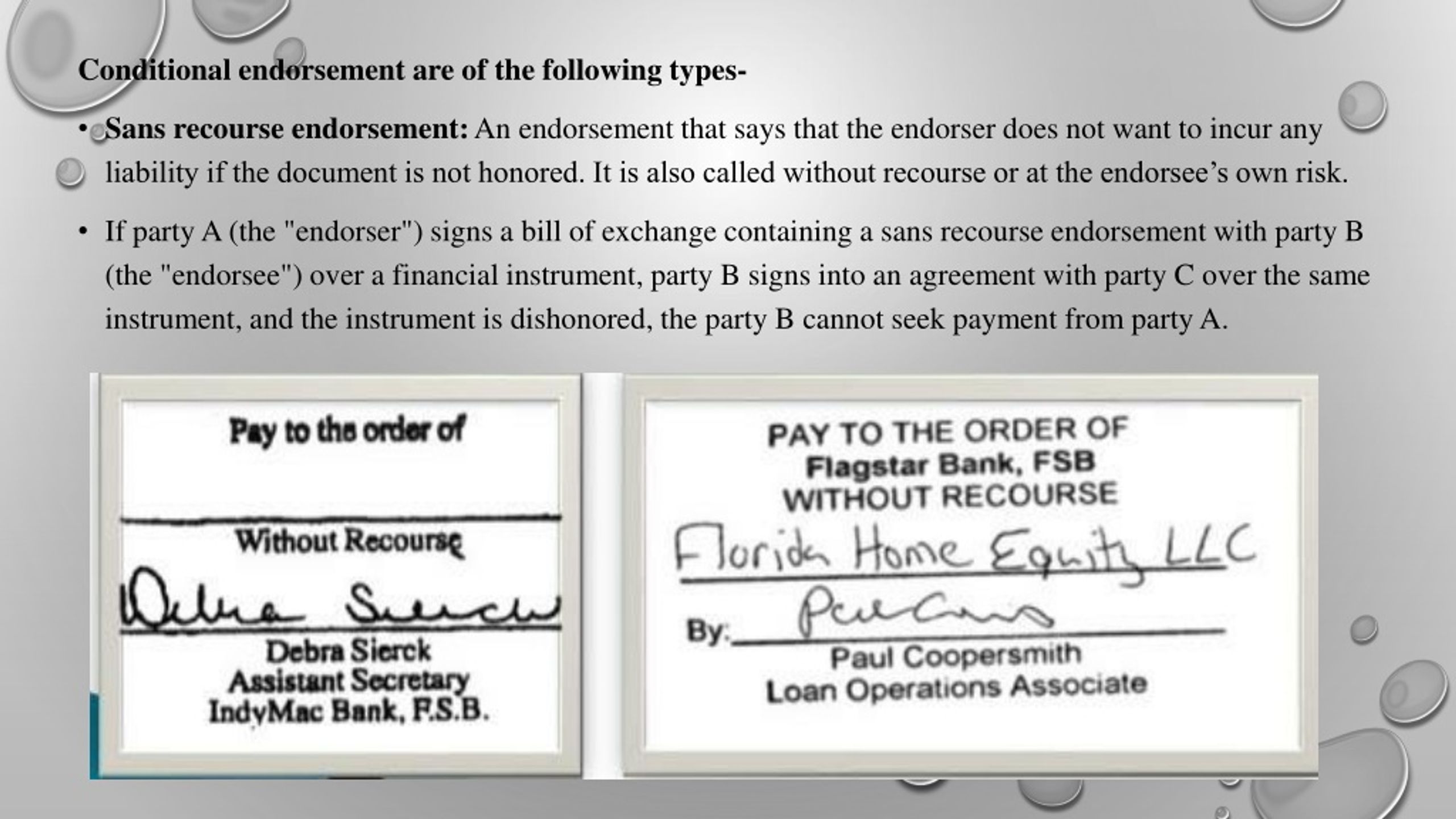

Endorsing Checks: Transferring Funds

While less common now, this used to happen more with checks. If someone writes a check to you, and you want to give that check to a third party instead of cashing it yourself, you would endorse it on the back. If you write "Pay to the order of [Third Party Name] without recourse" and sign it, you are transferring the check but are not guaranteeing that the check will clear. If the check bounces, the third party cannot come back to you for the money. This is, you know, a way to pass on a payment without taking on the risk of it failing.

Factoring: Selling Receivables

Businesses often sell their accounts receivable (money owed to them by customers) to a factoring company. This gives them immediate cash instead of waiting for customers to pay. When a business sells its receivables "without recourse," it means the factoring company takes on the risk that customers might not pay. If a customer defaults, the factoring company cannot demand the money back from the business that sold the receivable. This is, you know, a pretty big deal for cash flow and risk management for many companies.

Why Does Anyone Use "Without Recourse"?

There are clear reasons why someone would want to use or accept a "without recourse" arrangement. It's all about managing risk and responsibility. For the person giving the endorsement, it offers a form of protection. For the person accepting it, there's usually a trade-off. It's, well, about weighing what you get versus what you give up.

For the Endorser: Limiting Financial Risk

The main reason someone would endorse something "without recourse" is to limit their financial risk. Once they transfer the financial instrument, they are no longer responsible if the original payer defaults. This can be very appealing for someone who wants to get rid of a potential future headache or who needs to get a financial asset off their books. It's, you know, a way to wash your hands of a future problem.

For example, a small business that sells its customer invoices to a factoring company "without recourse" doesn't have to worry if one of their customers goes out of business and can't pay. The factoring company, not the small business, absorbs that loss. This allows the business to focus on its core operations without carrying the burden of potential bad debts. This, honestly, can be a huge relief for many business owners.

For the Receiver: Accepting More Risk for Benefit

On the flip side, why would anyone accept something "without recourse"? Typically, they do so because they get something else in return. This could be a discount on the price of the asset, or perhaps they have a very good reason to believe the original payer will indeed pay. They are essentially taking on more risk for a potentially greater reward or a more favorable deal. It's, well, a calculated move.

A factoring company, for instance, might pay a little less for receivables sold "without recourse" compared to those sold "with recourse." That lower price is their compensation for taking on the default risk. They do their own homework on the customers' creditworthiness before agreeing to the deal. So, they are, you know, doing their due diligence.

"With Recourse" Versus "Without Recourse": A Key Difference

Understanding the difference between "with recourse" and "without recourse" is pretty important. It's the core of who carries the bag if something goes wrong. The presence or absence of that single word "without" completely changes the agreement. This is, you know, a very important distinction to grasp.

Understanding the Liability

When an endorsement is made "with recourse," the person endorsing the instrument remains responsible if the original payer fails to pay. This means if a check bounces or a promissory note isn't honored, the holder of the instrument can come back to the endorser and demand payment. The endorser is, well, still on the hook. This is the standard assumption if "without recourse" isn't explicitly stated.

Conversely, an endorsement "without recourse" removes that responsibility from the endorser. The risk of non-payment shifts entirely to the new holder of the instrument. The original endorser is no longer liable. It's like saying, "Here's this thing, but I'm not guaranteeing it will work out." That, you know, is a pretty big difference in terms of financial responsibility.

Real-Life Impact on Agreements

The choice between "with recourse" and "without recourse" has real-world consequences for all parties involved. It influences pricing, risk assessment, and the overall structure of financial deals. For instance, a lender selling a loan might get a lower price if they sell it "without recourse" because the buyer is taking on more risk. They are, you know, paying for that peace of mind.

Similarly, a business might get less cash upfront from a factoring company for their invoices if the arrangement is "without recourse." But in exchange, they gain protection from customer defaults, which can be a valuable trade-off. It's a balance, really, between immediate gain and future safety. This is, you know, something that often requires careful thought.

What to Consider Before You Sign or Accept

Before you put your name on anything or agree to accept a financial instrument, it's a good idea to know what you're getting into. This is especially true when "recourse" is part of the conversation. Asking the right questions can save you a lot of trouble later. You, like your coffee, should know what you're getting.

For the Person Giving the Endorsement

- Are you comfortable giving up your right to pursue the original payer if things go wrong?

- What is the reputation of the person or entity you are transferring the instrument to?

- Is the value you are receiving for the transfer fair, considering you are taking on the risk of non-payment?

- Do you fully grasp the implications of not being able to seek payment from the endorser if the primary payer defaults?

- What are the specific terms of the agreement beyond just the recourse clause?

If you are the one endorsing "without recourse," you are basically saying, "I'm done with this." Make sure that's truly what you want. It's a way to get out from under a potential future obligation. This, honestly, can be a really smart move in some cases.

For the Person Receiving the Endorsement

- Have you done your homework on the original payer's ability to pay? This is your primary concern.

- Is the discount or benefit you're receiving for taking on the risk of non-payment worth it?

- Do you have a plan for what happens if the original payer defaults?

- Are there any other protections or guarantees in the agreement, even if it's "without recourse"?

- Consider getting a legal professional to look over the document before you commit.

If you are accepting something "without recourse," you are essentially trusting the original payer entirely. You are, well, betting on their ability to pay. It means you can't come back to the person who gave it to you if it doesn't work out. This requires, you know, a bit more caution.

Frequently Asked Questions About Recourse

People often have similar questions about these kinds of financial terms. Let's look at a few common ones. These are, you know, things that often come up in conversations about money.

What is the difference between "with recourse" and "without recourse"?

The main difference lies in who carries the financial risk if the original payer doesn't pay. "With recourse" means the endorser remains responsible and can be pursued for payment. "Without recourse" means the endorser is free from that responsibility; the new holder takes on all the risk. It's, well, about where the buck stops.

When is a "without recourse endorsement" used?

It's typically used when someone wants to transfer a financial instrument, like a promissory note or an invoice, to another party but wants to avoid any future liability if the original debtor defaults. Common scenarios include selling loans, transferring checks, or factoring accounts receivable. This is, you know, pretty specific to certain types of financial dealings.

Does "without recourse" protect the endorser completely?

For the most part, yes, it protects the endorser from liability if the original payer defaults. However, it doesn't protect against all possible issues, such as if the instrument itself was forged or if there was fraud involved in its creation. It's a protection against default, not against every possible legal issue. So, you know, it's a very specific kind of protection.

Protecting Your Financial Position Today

Understanding terms like "without recourse endorsement" is a valuable skill in today's financial climate. It gives you a better grasp of the agreements you might encounter, whether you're a business owner, an investor, or just someone trying to make sense of a personal loan. Knowing these details helps you make choices that protect your money and your peace of mind. It's, well, a bit like having a sturdy structure within and without your financial plans.

Just as you wouldn't want to be without essential knowledge in any part of your life, being informed about financial terms is a good idea. This kind of knowledge helps you see the whole picture. It's a way to avoid surprises and feel more confident about your financial dealings. You can learn more about financial liability on other sites, and also learn more about financial agreements on our site, and link to this page understanding risk in agreements.

As of November 19, 2023, these principles remain constant, even as the financial world shifts. While the specific applications might change, the core meaning of "without recourse" stays the same. It’s about who carries the risk, and that’s a pretty timeless concept in money matters. So, you know, keep this idea in your back pocket.

Ultimately, when you see "without recourse endorsement," you should now have a much clearer picture of what it means. It's a declaration that the person signing it over is not responsible if the primary debtor fails to pay. This knowledge can empower you to ask the right questions and make informed choices about your financial future. It's, well, a small detail that can make a big difference.

If you find yourself facing an agreement with this term, especially one involving a lot of money, it's always a good idea to talk with a financial advisor or a legal professional. They can offer advice specific to your situation. This way, you can be absolutely sure you are making the best choice for yourself. You know, it's always good to have expert eyes on important papers.

BUSINESS LAW ppt

PPT - BANKING LAW AND OPERATIONS PowerPoint Presentation, free download

Krayonnz : Social Learning Network