Paying Your Credit One Bank Bill Online: A Simple Guide

Managing your credit card payments feels like a big part of keeping your finances in good shape. For Credit One Bank cardholders, knowing the best ways to handle your bill is a pretty important step. This guide is all about helping you understand how easy it can be to make your Credit One Bank online payment. It’s a way to keep things running smoothly, honestly, and make sure your credit stays healthy.

Many folks are looking for simple ways to handle their money matters these days. Paying bills online offers a lot of ease, and it's a popular choice for good reason. You get to avoid paper statements, and you can take care of things from nearly anywhere, which is rather convenient.

We will walk through the steps for making your Credit One Bank online payment. We’ll cover what you need to know, how to do it, and some tips to help you along the way. It’s a straightforward process, you know, and helps you stay on top of your credit responsibilities.

Table of Contents

- Why Pay Online with Credit One Bank?

- Getting Started with Your Credit One Bank Online Payment

- Making a One-Time Credit One Bank Online Payment

- Setting Up Automatic Credit One Bank Payments

- Understanding Payment Processing Times

- Troubleshooting Common Online Payment Issues

- Other Ways to Pay Your Credit One Bank Bill

- Frequently Asked Questions About Credit One Bank Online Payments

Why Pay Online with Credit One Bank?

Paying your Credit One Bank bill through their online system offers a lot of good things. For one, it’s super convenient. You can pay from your home, a coffee shop, or really any place with internet access. This means no more searching for stamps or waiting in lines, which is a big time-saver for many people.

Online payments also help you avoid late fees. When you pay online, you get instant confirmation. This helps make sure your payment goes through before your due date. It's a pretty simple way to keep your account in good standing, actually.

Another benefit is tracking. The online system lets you see your payment history. You can check past payments and pending ones, which gives you a clear picture of your account. This transparency helps you manage your money better, you know, and keeps you informed.

Getting Started with Your Credit One Bank Online Payment

Before you can make a Credit One Bank online payment, you’ll need to have an online account set up. This is a pretty basic step for most online services today. It just takes a few minutes to get things ready, which is good.

Setting Up Your Online Account

If you haven't done this already, you'll want to visit the official Credit One Bank website. Look for a link that says something like "Register" or "Enroll Now." You'll typically need your credit card number, your Social Security number, and possibly your date of birth. This helps them confirm who you are, obviously.

After entering your details, you'll pick a username and a password. Make sure your password is strong and something you can remember. It's really important to keep your login information safe, as a matter of fact, to protect your account.

You might also set up security questions. These questions help verify your identity if you ever forget your password. It’s a good extra layer of safety, you know, for your account.

Logging In to Your Credit One Bank Account

Once your account is set up, you can go back to the Credit One Bank website. Look for the "Login" button. You’ll then enter the username and password you just created. This gets you into your personal account area, where you can manage everything.

Sometimes, they might ask for an extra verification step. This could be a code sent to your phone or email. This is just to make sure it's really you trying to get in. It's a common security measure, and it's there to protect your money, honestly.

Making a One-Time Credit One Bank Online Payment

Making a single payment online is a popular way to manage your bill. It gives you control over when and how much you pay. This is especially helpful if your income varies or if you want to pay more than the minimum, which is often a good idea for your credit.

Finding the Payment Section

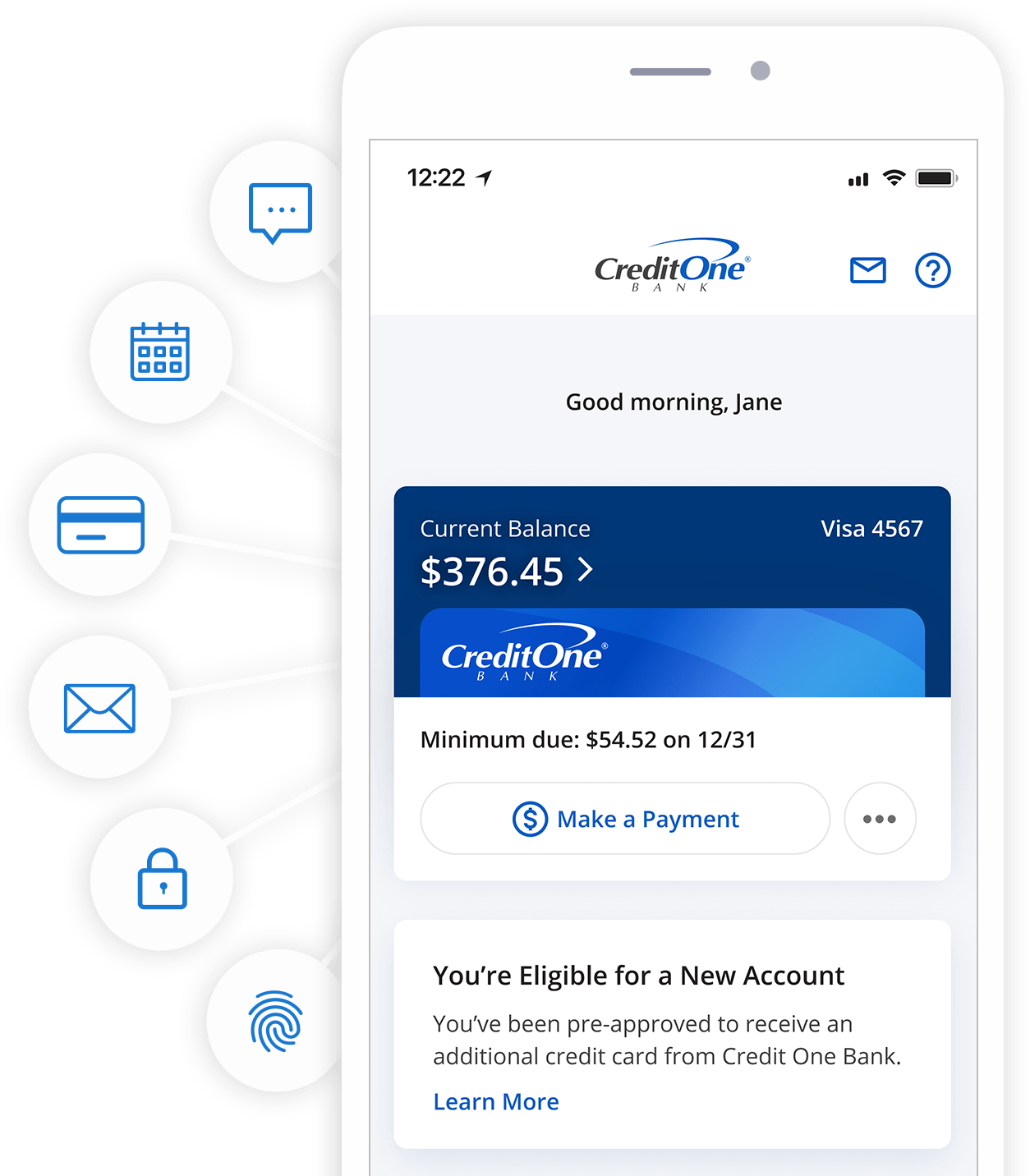

After you log into your Credit One Bank online account, look for a section labeled "Payments" or "Make a Payment." This is usually pretty easy to spot on the main dashboard. It's typically a prominent button or link, you know, designed for quick access.

You might see your current balance, minimum payment due, and due date displayed there. This information helps you decide how much to pay. It’s all laid out clearly, so you can make an informed choice, which is helpful.

Entering Your Payment Details

When you click to make a payment, you'll need to enter your bank account information. This includes your bank's routing number and your account number. Make sure these numbers are absolutely correct, because a wrong number can cause problems, obviously.

You'll also specify the payment amount. You can pay the minimum, the full statement balance, or any amount in between. It's usually a good idea to pay as much as you can, perhaps even the full balance, to avoid interest charges and keep your credit healthy, you know.

Then, you pick the date you want the payment to go through. It's smart to pick a date a few business days before your actual due date. This gives the bank time to process everything, which is often a day or two, as a matter of fact, for credit card payments.

Confirming Your Payment

Before you finalize things, the system will show you a summary of your payment. Check all the details carefully: the amount, the date, and your bank account information. This is your last chance to catch any mistakes, so take your time, you know.

Once you confirm, you'll usually get a confirmation number or a message saying your payment was successful. It's a good idea to write down this confirmation number or take a screenshot. This is your proof that you made the payment, which can be useful if any questions come up later, you know.

Setting Up Automatic Credit One Bank Payments

Automatic payments, often called auto-pay, are a really popular feature for many cardholders. They take away the worry of forgetting a payment. This can be a huge help for people with busy lives, you know, and it's very convenient.

Benefits of Auto-Pay

The biggest benefit is never missing a payment. This helps your credit score stay strong and avoids late fees. Consistent on-time payments are a big part of good credit, so this is a great way to support that, you know, and keep things simple.

It also saves you time. You set it up once, and then you don't have to think about it again unless you want to change something. This frees up your mental energy for other things, which is pretty nice, honestly.

You can usually choose to pay your minimum amount, your statement balance, or a fixed amount each month. This flexibility means you can tailor it to your financial situation. It’s a pretty smart way to manage your money, you know, without much effort.

How to Set It Up

To set up auto-pay, log into your Credit One Bank online account. Look for the "Payments" section, and then find an option like "Set Up AutoPay" or "Recurring Payments." This will guide you through the process, which is fairly simple.

You’ll need to provide your bank account details, just like with a one-time payment. You’ll also choose the payment amount and the date. Many people pick the statement balance to avoid interest, but the minimum is also an option. It's all about what works for you, honestly.

Always double-check the details before confirming. You'll get a confirmation message once it's active. It's still a good idea to glance at your statements each month to make sure everything is working as it should. This keeps you informed, you know, and on top of your finances.

Understanding Payment Processing Times

When you make a Credit One Bank online payment, it's good to know how long it takes for the payment to post to your account. This is important for avoiding late fees and knowing your available credit. Payments typically take a day or two to process, as a matter of fact, sometimes a little longer.

If you pay on a weekend or a holiday, the processing might start on the next business day. So, a payment made on a Saturday might not start processing until Monday. This is just how banks work, you know, and it's pretty standard.

Always aim to make your payment several days before your due date. This gives you a buffer in case there are any unexpected delays. It’s a simple habit that can save you a lot of worry, and it really helps your credit standing, too.

Troubleshooting Common Online Payment Issues

Sometimes, things don't go exactly as planned. If you run into an issue with your Credit One Bank online payment, don't worry. There are usually simple solutions. It’s pretty common for people to have questions, you know, about these things.

First, check your internet connection. A shaky connection can interrupt the payment process. Make sure you have a stable connection before trying again. This is a basic first step, obviously, but it often solves the problem.

Double-check your bank account and routing numbers. A single wrong digit can cause the payment to fail. It’s a very common mistake, honestly, so take a careful look. If the numbers are wrong, the payment won't go through, and you might even get a fee from your bank.

If the website seems to be having issues, try clearing your browser's cache and cookies. Or, try a different web browser. Sometimes, these simple steps can fix technical glitches. It's worth a try, you know, before doing anything else.

If you're still having trouble, contact Credit One Bank's customer service. They can look into your account and help you figure out what’s going on. They are there to support you if you need advice, which is helpful, you know, for these kinds of things.

Other Ways to Pay Your Credit One Bank Bill

While making a Credit One Bank online payment is convenient, it’s not the only way to pay. It’s good to know your other options, just in case. Having choices is always a good thing, you know, for managing your money.

You can pay by phone. Credit One Bank usually has an automated payment system or a customer service number you can call. This is a good option if you don't have internet access or prefer to speak with someone. It's pretty straightforward, honestly, to do it this way.

You can also send a payment by mail. This involves sending a check or money order to the address provided on your statement. This method takes longer, so you need to mail it well in advance of your due date. It’s a bit slower, you know, than online payments.

Some people might consider paying in person, but Credit One Bank doesn't have physical branches like traditional banks. So, you can't just walk into a branch to pay. If you needed something like a cashier's check, you would need to wait for that, or perhaps use a local credit union for cash deposits and any in-person needs, which is a good idea for some folks, you know, for general banking needs.

Remember, the goal is to make sure your payment reaches Credit One Bank on time. This helps improve your credit, keep it healthy, and supports you in decisions that may affect your credit livelihood. We are here to support you if you need advice on these matters, which is good, you know, for your financial well-being. Learn more about managing your credit on our site, and link to this page for more payment tips.

Frequently Asked Questions About Credit One Bank Online Payments

People often have similar questions about making their Credit One Bank online payment. Here are some common ones that come up, you know, for cardholders.

How long does it take for a Credit One Bank online payment to post?

Typically, an online payment takes about one to two business days to post to your account. If you make a payment on a weekend or holiday, it usually starts processing on the next business day. It’s a pretty quick process, you know, for most online payments.

Can I schedule a Credit One Bank payment for a future date?

Yes, you can. When you set up a one-time payment, you'll have the option to pick a future date for the payment to go through. This is really helpful if you want to set it and forget it for a bit, you know, before your due date arrives.

What if I accidentally pay more than my Credit One Bank balance?

If you overpay your Credit One Bank balance, the extra amount will typically show as a credit on your account. This credit can then be used for future purchases or applied to your next statement. You can also usually request a refund for the overpayment, which is pretty straightforward to do, you know, by contacting customer service.

Credit One Bank Mobile App for Online Banking | Credit One Bank

Credit One Bank Mobile App for Online Banking | Credit One Bank

How To Login Credit One Bank Online Banking (2023) - YouTube