Understanding The USD To Iranian Rial Exchange: What Shapes Its Value?

Have you ever wondered what makes one currency stronger or weaker against another? It’s a pretty common thought, especially when you hear about exchange rates like the USD to Iranian Rial. This particular pairing, you know, captures a lot of attention because it reflects some truly unique economic dynamics. People often find themselves curious about this specific exchange, perhaps because they have family abroad, are looking at global news, or just want to grasp how currencies work on a broader scale. It's a topic that, you could say, really gets people thinking about money and its worth across borders.

The United States dollar, or USD, is a currency that, honestly, plays a huge role around the world. It’s the official money for the United States, of course, and also for quite a few other countries, too. You see it everywhere, from international trade deals to just about any financial market you can think of. It’s often considered, well, a kind of global standard, and that’s a pretty big deal when we talk about its value against other currencies, like the Iranian Rial. It really sets a baseline for so many exchanges.

When we look at the Iranian Rial, it's a very different story, in some respects. Its value against the USD, and other major currencies, tends to be influenced by a distinct set of factors. So, understanding this particular exchange isn't just about looking up a number; it's about getting a feel for the forces that push and pull on both sides. It's almost like watching a very complex dance between two very different partners on the global stage, each with their own rhythm and challenges.

Table of Contents

- The United States Dollar: A Global Pillar

- What is the Iranian Rial?

- Factors Influencing the USD to Iranian Rial Rate

- Understanding Exchange Rate Dynamics

- Staying Informed About the Rate

- Frequently Asked Questions

- Conclusion

The United States Dollar: A Global Pillar

The United States dollar, often simply called the dollar, is, quite literally, the official money of the United States of America. It’s also the currency abbreviation for USD, you know, which you see on all the currency charts. This currency has a pretty long history, with the Coinage Act of 1792 being a key moment in its introduction. It's not just used in the US; several other countries also consider it their official tender, which is rather interesting.

What makes the USD so important, you might ask? Well, it’s actually the most exchanged currency across the globe, ahead of even the euro and the Japanese yen. This means that a lot of international transactions, deals, and financial agreements are done using dollars. It serves as a global reserve currency, which is a big deal in international trade and financial markets. This role means that many countries hold a good chunk of their foreign currency reserves in USD, which, in a way, shows its widespread acceptance and trust.

The strength of the US dollar is often measured by something called the US Dollar Index, or DXY. This index, you see, tracks the dollar’s value against a basket of other major currencies. When the DXY goes up, it generally means the dollar is getting stronger compared to these other currencies. On the other hand, if it goes down, the dollar is weakening. For example, our currency rankings show that the most popular US dollar exchange rate is the USD to EUR rate, which is just one piece of the puzzle, apparently.

Even with its strong standing, the dollar's value can shift. For instance, despite a recovery in July, the US dollar is likely to weaken in the next 12 months, you know, pressured by lower growth and policy uncertainty. This goes to show that even the most dominant currency in the world isn't immune to economic ups and downs. So, while it's a global pillar, its value is always moving, always reacting to what’s happening in the world, which is kind of fascinating.

What is the Iranian Rial?

The Iranian Rial, or IRR, is the official money of Iran. It's a currency that, like many others, has its own unique story and a very distinct set of influences on its value. Unlike the widely used US dollar, the Rial's international presence is, well, somewhat limited. It's primarily used within Iran for daily transactions and local business. This local focus means its value is often more sensitive to internal economic conditions and, in some respects, specific geopolitical factors that might not affect other major currencies as much.

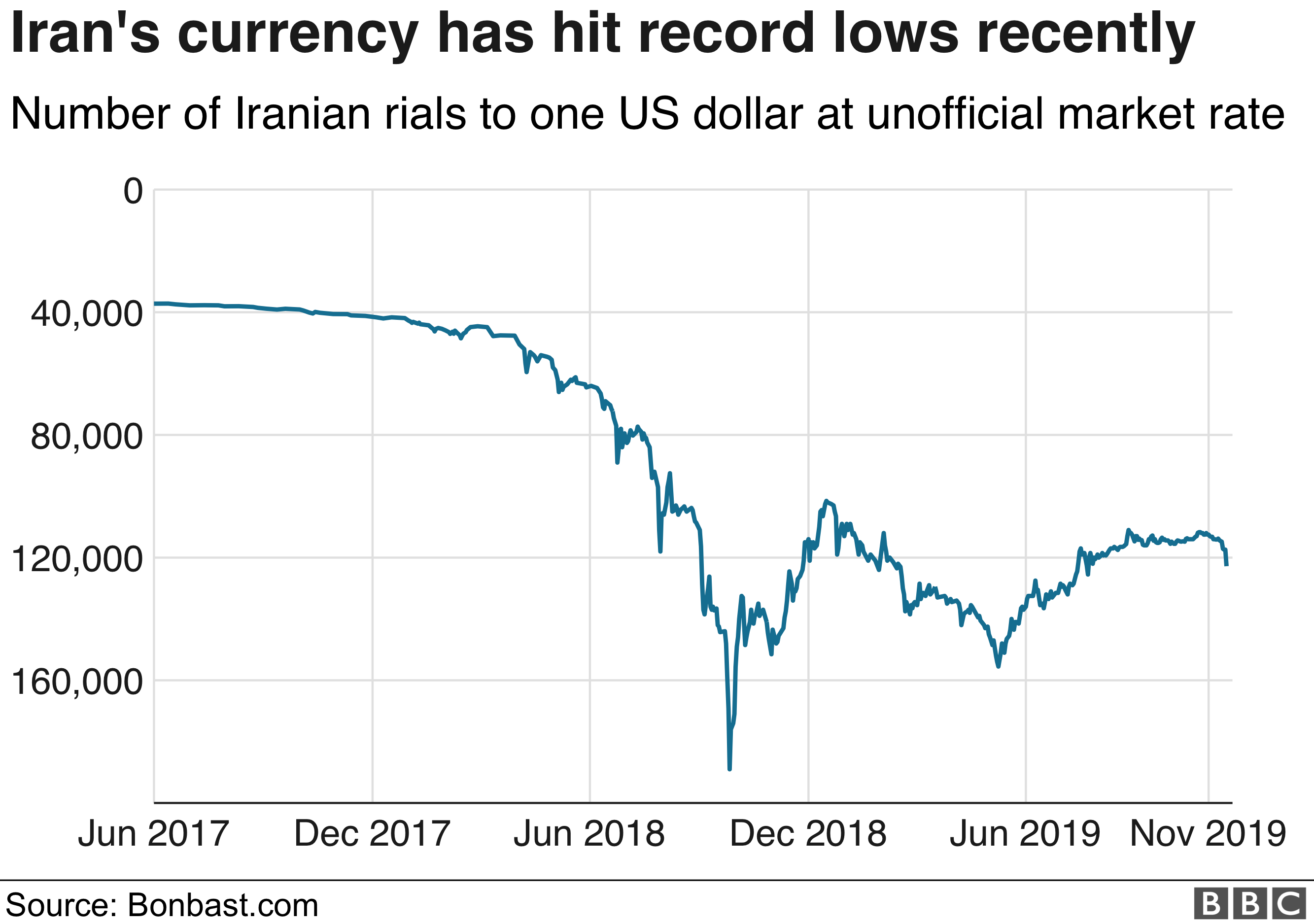

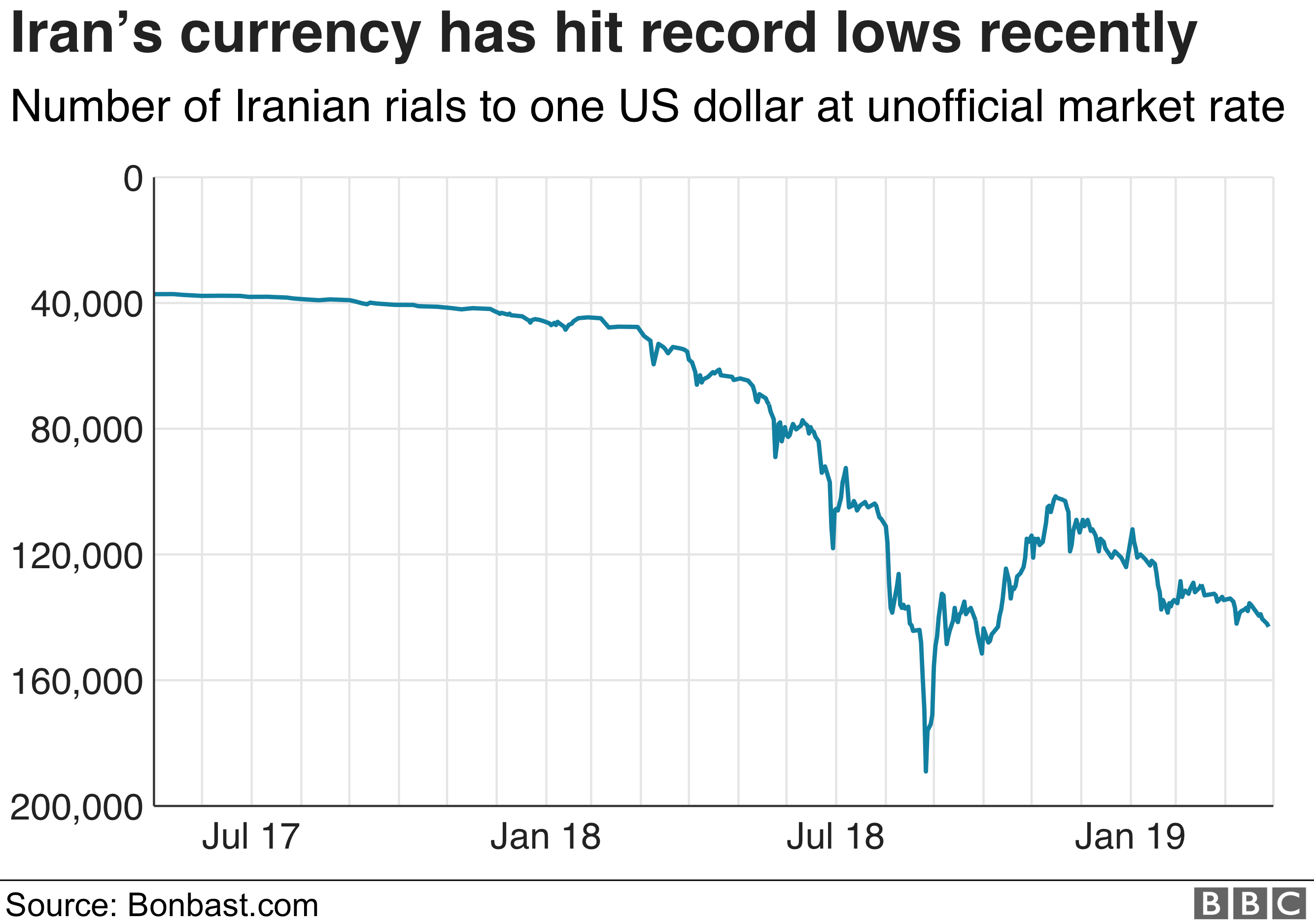

Over time, the Iranian Rial has, in a way, seen significant fluctuations in its exchange rate against currencies like the USD. These changes are often a reflection of Iran's economic situation, including things like inflation rates, government policies, and the country's trade balance. It’s a currency that, you know, is constantly being watched by those with connections to Iran, whether they are living there, have family, or are involved in any kind of cross-border activity. Its movements can really impact daily life for people.

For anyone looking to understand the USD to Iranian Rial rate, it's important to remember that the Rial operates in a somewhat different environment than, say, the Euro or the Japanese Yen. Its value is often discussed in terms of its purchasing power within Iran, and how that relates to goods and services that might be imported. So, it's not just about a simple number; it's about the broader economic picture of the country, which can be quite complex, you know, and always changing.

Factors Influencing the USD to Iranian Rial Rate

When you look at the exchange rate between the USD and the Iranian Rial, it's never just a random number. There are, honestly, many powerful forces that push and pull on this value, making it change day by day, sometimes even hour by hour. Understanding these influences can help anyone make a bit more sense of why the rate is what it is. It's almost like trying to figure out the weather; there are lots of things contributing to it.

Economic Health and Growth

The overall health of both the US and Iranian economies plays a very big part. For the US dollar, things like lower growth and policy uncertainty can, you know, put pressure on its value, as mentioned in the text. When an economy is doing well, with strong growth and low unemployment, its currency tends to be more attractive to investors, which can make it stronger. Conversely, if an economy is struggling, its currency might weaken, as people look for safer places to put their money. This is a pretty basic principle, you know, but it applies to both currencies, just in different ways.

Government Policy and Stability

Government decisions and the general stability of a country can have a huge impact on its currency's value. In Iran, for instance, government policies related to trade, banking, and even domestic spending can directly affect the Rial. If policies are seen as unstable or unfavorable by the market, it can lead to a loss of confidence, which then, you know, often causes the currency to lose value. Similarly, central bank actions, like setting interest rates, can influence how attractive a currency is to hold, which is something that affects the USD too, of course.

Supply and Demand

Just like with anything else, the basic rules of supply and demand apply to currencies. If there's a high demand for US dollars, perhaps because people need them for international trade or investment, the USD's value will tend to go up. If there's a lot of US dollars available but not much demand, its value might drop. The same goes for the Iranian Rial. If there are fewer Rials available for exchange, or if demand for them increases (perhaps due to increased tourism or exports), its value could strengthen. It's a pretty straightforward concept, you know, but it drives a lot of the daily fluctuations.

International Relations

This is a particularly significant factor for the Iranian Rial. Geopolitical events, international agreements, or, you know, even disagreements between countries can have a profound effect on a nation's economy and, by extension, its currency. When a country faces external pressures, it can make it harder for businesses to operate, for trade to flow freely, or for foreign investment to come in. This can lead to a reduced demand for the local currency and, consequently, a weakening of its value against major currencies like the USD. It's a factor that, in some respects, adds a lot of unpredictability to the Rial's movements.

Understanding Exchange Rate Dynamics

Knowing about the factors that influence currency rates is one thing, but understanding how those dynamics play out in real-time is, well, another challenge entirely. Exchange rates are constantly moving, reflecting a continuous interplay of all these economic and political forces. It's not a static number you can just look up once and be done with it. For the USD to Iranian Rial rate, this constant movement is, honestly, very noticeable, and it’s something that people who deal with it regularly have to keep an eye on.

Sometimes, you might hear about different rates for the same currency pair, like an official rate versus a market rate. This can happen in situations where there are restrictions on currency exchange or where there's a significant gap between the government's set value and what people are willing to pay on the open market. This kind of situation, you know, adds another layer of complexity to understanding the true value of the Rial against the dollar. It’s not always as simple as just checking one source.

For individuals or businesses looking to exchange currency, or even just to understand its worth, it’s really important to look at updated spot exchange rates. These are the rates for immediate delivery of a currency, and they give you the most current picture. Finding currency and selling price information, along with other forex details, is something that many people do to stay on top of things. It’s almost like checking the weather forecast before you head out, you know, because things can change pretty quickly.

The US dollar, as we've talked about, is a legal tender currency of the United States, and it serves as a global reserve currency in international trade and financial markets. This global standing means that changes in the US economy, even slight ones, can ripple out and affect exchange rates all over the world, including the USD to Iranian Rial. So, while the Rial has its own unique pressures, the dollar's global role means its movements are, in a way, always a part of the equation.

Staying Informed About the Rate

Given how much the USD to Iranian Rial exchange rate can move, staying informed is, honestly, pretty important for anyone who cares about it. You can get US dollar rates, news, and facts from various sources. There are also services that offer things like cheap money transfers or currency data APIs, which can be helpful for those who need real-time information. It’s about finding reliable places to get your information, you know, because accuracy really matters here.

When you're looking for information, it's a good idea to check multiple sources and to consider what might be influencing the rates you see. Is it a major economic announcement? A change in policy? Or perhaps a significant global event? All these things can, in a way, play a part. The currency code for dollars, USD, is universally recognized, making it easier to track, but the nuances of the Iranian Rial require a bit more specific attention, you could say.

Remember that the exchange rate you see online or in a news report might be different from the rate you actually get if you were to exchange money in person. There can be spreads, fees, and different rates offered by various financial institutions. So, while understanding the general trends is very useful, always be aware of the practicalities of currency exchange. It’s almost like the difference between knowing the average temperature for the day and the exact temperature in your backyard, you know?

The information about the currency United States Dollar (USD), including its HTML code, symbol, and exchange rate to other currencies of the world, is widely available. However, for the Iranian Rial, finding detailed, consistently updated information that reflects the true market can sometimes be a bit more of a challenge. So, for those interested in this specific pair, it means being a bit more diligent in their search for the most current and relevant data. You can learn more about currency exchange on our site, which might help you understand these dynamics better, too.

Frequently Asked Questions

Here are some common questions people often ask about the USD to Iranian Rial exchange rate, you know, because it's a topic that brings up a lot of curiosity.

What affects the USD to Iranian Rial exchange rate?

Many things can affect this rate, you know. Key factors include the economic health of both the US and Iran, government policies, how stable the political situation is, the basic supply and demand for each currency, and also, very importantly, international relations and geopolitical events. All these elements, in a way, combine to influence the daily value. It’s a very dynamic situation, honestly.

Is the Iranian Rial a strong currency?

Compared to major global currencies like the US dollar, the Iranian Rial has, you know, generally experienced significant weakening over time. Its value is often impacted by internal economic challenges and external pressures. So, in terms of international purchasing power, it tends to be less strong than many other currencies, which is something to keep in mind, apparently.

How can I find the current USD to Iranian Rial rate?

You can find current rates on various financial news websites, currency exchange platforms, or through banks and money transfer services. It's a good idea to check a few different sources to get a comprehensive picture, as rates can vary slightly between providers and, you know, they change constantly throughout the day. Always look for updated spot exchange rates for the most current information, which is usually the best approach.

Conclusion

So, we've talked quite a bit about the USD to Iranian Rial exchange rate, and how it's shaped by a mix of economic, political, and global forces. The US dollar, as you know, stands as a strong global currency, while the Iranian Rial's value is, in a way, more sensitive to specific regional and internal conditions. Understanding these differences and the factors that influence each currency can really help you make sense of the exchange rate you see. It’s not just a number; it's a reflection of complex interactions.

Keeping an eye on the news, understanding basic economic principles, and using reliable sources for currency information are, honestly, very good steps to take if you want to stay informed about this particular exchange. The world of currency is always moving, and knowing what drives those movements can give you a much clearer picture. So, whether you're interested for personal reasons or just curious about global finance, staying curious and informed is, you know, always a smart move.

Six charts that show how hard US sanctions have hit Iran - BBC News

Six charts that show how hard US sanctions have hit Iran | Shabtabnews

Dollar Vs Iranian Rial Chart - Ponasa